|

The economic data calendar was thin in the past week. It didn’t offer much that would change the outlook for the FOMC on January 28-29.

What may be most interesting and important is the series of winter storms that have affected business conditions in the US in the first weeks of January. Delays in transporting people and goods, cessation of outdoor activities not related to cold weather sports, widespread closures in school systems, and other weather-related disruptions will likely make the January data noisy when reports are released in February and March.

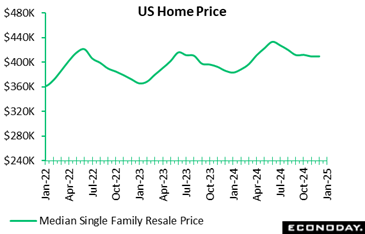

Perhaps no sector will feel the weather as much as housing. Starts of new homes will plunge in January. Although new home construction can be expected to rebound, recent increases in mortgage rates may mean that the normal start to the spring buying season is delayed. Potential homebuyers often begin the process of checking out local markets in January and February in preparation for serious shopping in March and April. Buyer traffic is going to be weaker in the near term.

The Freddie Mac rate for a 30-year fixed rate mortgage is down 8 basis points to 6.96 percent in the January 23 week from 7.04 percent in the prior week. Rates have been right around the 7-percent mark most of January, a level that pushes some potential buyers out of the market. The dip in the January 23 week probably isn’t a precursor to noticeably more moderate rates. The FOMC isn’t expected to send any signals for rate cuts when they meet next week.

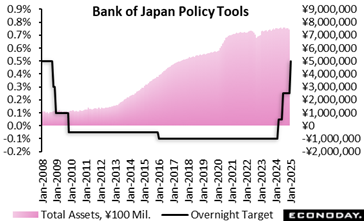

The Bank of Japan's nine-member board, as widely expected, voted 8 to 1 to raise the policy interest rate by another 25 basis points to 0.5 percent in a third rate hike during the current normalization process begun in March 2024. Board member Toyoaki Nakamura, a former Hitachi executive, voted against the rate hike at this point, giving the same reason that he did in July: It would be better to wait until next meeting, in March, and confirm whether firms' ability to earn profits are rising. The Bank of Japan's nine-member board, as widely expected, voted 8 to 1 to raise the policy interest rate by another 25 basis points to 0.5 percent in a third rate hike during the current normalization process begun in March 2024. Board member Toyoaki Nakamura, a former Hitachi executive, voted against the rate hike at this point, giving the same reason that he did in July: It would be better to wait until next meeting, in March, and confirm whether firms' ability to earn profits are rising.

Citing "significantly low" real interest rates, the board repeated its latest conviction that it should be able to continue raising the target for overnight interest rates and "adjust the degree of monetary accommodation" without hurting economic activity. Judging from views expressed by board members last year, the bank is staying the course of lifting the rate to at least 1 percent, which could still barely provide itself a wide safety margin when a global crisis hits.

In its quarterly Outlook Report issued after the two-day meeting that ended Friday, the board repeated its recent view verbatim: "Japan's economy is likely to keep growing at a pace above its potential growth rate, with overseas economies continuing to grow moderately and as a virtuous cycle from income to spending gradually intensifies against the background of factors such as accommodative financial conditions."

Board members also maintained their risk assessment, saying, "There remain high uncertainties surrounding Japan's economic activity and prices, including developments in overseas economic activity and prices, developments in commodity prices, and domestic firms' wage- and price-setting behavior."

"Under these circumstances, it is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan's economic activity and prices," the bank said, repeating its view expressed last month and in October. "In particular, with firms' behavior shifting more toward raising wages and prices recently, exchange rate developments are, compared to the past, more likely to affect prices."

The BOJ is in the process of normalizing its policy by gradually lifting the rates from zero and slightly negative at every third or fourth meeting. The BOJ under Governor Ueda, who took office in April 2023, shifted gear in March 2024 with its first rate hike in 17 years and an end to the seven-year-old yield curve control framework, following a decade of large monetary easing aimed at reflating the economy. The board stood pat in December, October and September after voting 7 to 2 in July to hike the rate to 0.25 percent from a range of 0 percent to 0.1 percent.

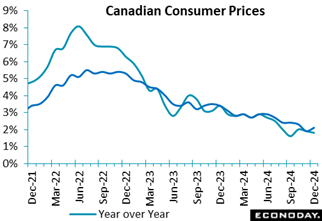

Canada's Consumer Price Index is down by 0.4 percent in December on a monthly basis, after coming in flat in November, matching expectations in the Econoday survey of forecasters. Canada's Consumer Price Index is down by 0.4 percent in December on a monthly basis, after coming in flat in November, matching expectations in the Econoday survey of forecasters.

Compared to December 2023, the CPI is up 1.8 percent, slowing down a bit from the 1.9 percent pace set in November, but also in line with expectations in the Econoday survey of forecasters.

Excluding food and energy prices, the CPI fell 0.1 percent on a monthly basis, same as in November. Compared to a year ago, the core CPI is up 2.1 percent in December vs. a 1.9 percent increase in November.

The average of the Bank of Canada's 'Alternative measures' of annual core inflation for December is 2.5 percent.

The inflation data remains in line with the Bank of Canada's outlook for consumer prices, with the central bank expecting inflation to average close to its 2 percent target "over the next couple of years." This provides support for the central bank's plan to keep inflation "close to the middle" of the 1 percent to 3 percent range.

Statscan noted that the government introduced a temporary GST/HST break on certain goods on December 14, 2024. The major components impacted by the tax break were food; alcoholic beverages, tobacco products, and recreational cannabis; recreation, education, and reading; and clothing and footwear.

As a result, food purchased from restaurants (-4.5 percent from November, -1.6 percent from a year ago) and alcoholic beverages purchased from stores (-4.1 percent and -1.3 percent) contributed the most to the deceleration in consumer prices. The CPI excluding food rose 2.1 percent on an annual basis in December.

Compared to a year ago, gasoline prices jumped 3.5 percent in December compared with November's decline of 0.5 percent. Consumer prices excluding gasoline rose 1.8 percent year over year last month, after rising by 2 percent in November and 2.2 percent in October. On a monthly basis, gasoline prices are down 0.6 percent in December following no change in November.

Shelter price growth continued to slow down in December, but remains elevated – rising 4.5 percent year over year, compared with a 4.6 percent increase in November. Rent is up 7.1 percent from December 2023, slowing down from November's 7.7 percent rise.

Prices for goods are down 0.1 percent from a year ago in December, after no change in November. Meanwhile, prices for services jumped 3.5 percent in December, the same pace as in November.

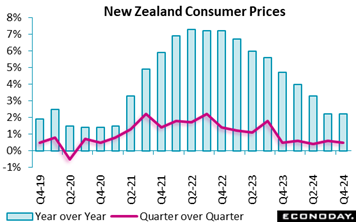

New Zealand consumer prices rose 2.2 percent on the year in the three months to December, as they did in the three months to September. This is just above the consensus forecast of 2.1 percent and leaves headline inflation within the Reserve Bank of New Zealand's target range of 1.0 percent to 3.0 percent for the second consecutive quarter after it had been above that range since early 2021. The index advanced 0.5 percent on the quarter after increasing 0.6 previously, matching the consensus forecast. New Zealand consumer prices rose 2.2 percent on the year in the three months to December, as they did in the three months to September. This is just above the consensus forecast of 2.1 percent and leaves headline inflation within the Reserve Bank of New Zealand's target range of 1.0 percent to 3.0 percent for the second consecutive quarter after it had been above that range since early 2021. The index advanced 0.5 percent on the quarter after increasing 0.6 previously, matching the consensus forecast.

Steady headline inflation in the three months to December reflects offsetting moves among major categorise of expenditure. Transport prices fell at a less pronounced pace and food price inflation picked up from 0.7 percent to 1.3 percent, while housing and utilities prices rose at a slightly slower pace. Education prices also fell sharply but steadily, as a result of a government rebate for early childhood education.

The RBNZ reduced the official cash rate by 50 basis points to 4.25 percent at its most recent meeting late November, following a 50 basis point cut and a 25 basis point cut at its two previous meetings. In the statement accompanying this month's decision, officials advised that they now consider inflation to be "sustainably within" their target range and advised that they expect to cut rates further in upcoming meetings to help support a recovery in economic growth. Today's data showing headline inflation is steady within the target range is likely to support the case for another rate cut at their next scheduled policy meeting mid-February.

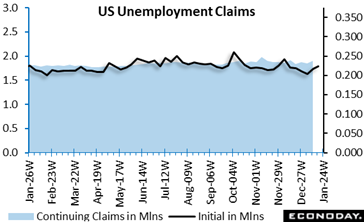

Initial jobless claims came in higher than expected in the latest week, up by 6,000 in the week ending January 18 from the unrevised 217,000 level reported for the prior week. The January 18 week's level compares to the consensus of 218,000 in the Econoday survey of forecasters. The four-week moving average is up 750 to 213,500 in the January 18 week, after 212,750 in the prior week. Initial jobless claims came in higher than expected in the latest week, up by 6,000 in the week ending January 18 from the unrevised 217,000 level reported for the prior week. The January 18 week's level compares to the consensus of 218,000 in the Econoday survey of forecasters. The four-week moving average is up 750 to 213,500 in the January 18 week, after 212,750 in the prior week.

The volatility in initial jobless claims continues. Seasonal factors had expected a decrease in unadjusted claims of 75,722 (-21.5 percent) from the previous week's post-holiday surge, but the actual decline was less, -68,135 or -19.3 percent.

There was a noticeable jump in unadjusted first-time claims filed in California – not surprising given the devastating LA wildfires. There was a major decline in applications filed in Georgia, Illinois, Kentucky, Michigan, Missouri, New Jersey, New York, Ohio, Pennsylvania, South Carolina, and Texas.

Insured unemployment increased by 46,000 in the January 11 week to 1.899 million, from a downwardly revised 1.853 million in the prior week – and continuing claims are now 138,000 higher compared to the same week a year ago, a continuous reminder of the softening labor market. The four-week moving average is up 500 to 1.866 million, from an upwardly revised 1.865 million in the January 4 week. The insured rate of unemployment remained at 1.2 percent in the January 11 week, continuing the trend seen for most of 2024 and into the start of this year.

The spike in initial claims numbers, plus the elevated level of continuing claims, underlines the lukewarm labor market in which the hiring pace remains moderate.

Advance estimates for South Korean GDP show the economy remained weak in the three months to December. GDP rose just 0.1 percent on the quarter, matching the growth recorded in the three months to September, with year-over-year growth slowing from 1.5 percent to 1.2 percent. This is the slowest year-over-year growth in six quarters. PMI surveys also showed modest growth in South Korea's manufacturing sector in November, followed by renewed contraction in December, with monthly industrial production data showing weak growth. Advance estimates for South Korean GDP show the economy remained weak in the three months to December. GDP rose just 0.1 percent on the quarter, matching the growth recorded in the three months to September, with year-over-year growth slowing from 1.5 percent to 1.2 percent. This is the slowest year-over-year growth in six quarters. PMI surveys also showed modest growth in South Korea's manufacturing sector in November, followed by renewed contraction in December, with monthly industrial production data showing weak growth.

This ongoing weakness in headline GDP growth in the three months to December reflects a sharp contraction in investment spending, down 0.9 percent on the quarter after previous growth of 0.2 percent. Consumption spending also slowed, up 0.3 percent on the quarter after advancing 0.5 percent previously. Exports rose 0.3 percent after falling 0.1 percent previously, while government consumption rose at a steady pace.

At their most recent policy meeting earlier this month, officials at the Bank of Korea left policy rates on hold at 3.25 percent. This decision partly reflected uncertainty about the economic outlook but officials also noted recent exchange rate volatility in response to "unexpected political risks" and "the changing domestic political situation" following last month's short-lived period of martial law. These factors appear to have convinced officials that policy should stay on hold for now, but they also signalled that further cuts will be considered in coming months to help mitigate downside risk to growth. This will likely reinforce the case for further policy easing.

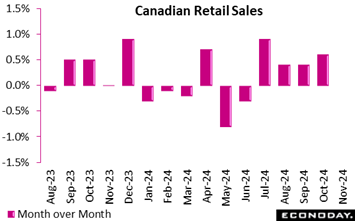

Retail sales in Canada were flat in November from October, right in line with the expected unchanged reading. In volume terms, sales fell 0.4 percent on the month. Sales were up 1.6 percent year-over-year. Retail sales in Canada were flat in November from October, right in line with the expected unchanged reading. In volume terms, sales fell 0.4 percent on the month. Sales were up 1.6 percent year-over-year.

The advance estimate for December sales suggests a remarkable increase of 1.6 percent from November.

Sales fell in six of nine subsectors in November from October. The biggest movers: a 1.6 percent decline in sales at food and beverage retailers, which was largely offset by an increase of 2.0 percent at motor vehicles and parts and fuel vendors, up 0.7 percent.

Core retail sales, which omit gasoline and motor vehicles, fell by 1.0 percent in November from October, not a pretty picture. Core sales rose a muted 0.8 percent from a year ago.

The decline in core sales, its largest in six months, reflected the 1.6 percent fall in food and beverage sales and a 1.0 percent decrease in sales of general merchandise. There was also a decline of 2.1 percent in sales by building material and garden equipment and supplies dealers in November from October.

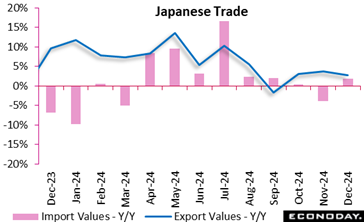

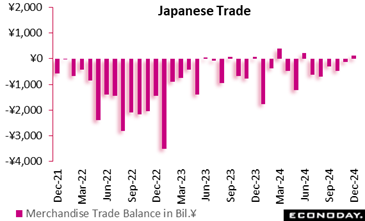

Japanese export values rose 2.8 percent on year in December (close to consensus +3.0 percent) to a record high ¥9.91 trillion, posting their third straight year-on-year rise and leading to an unexpected trade surplus. The increase was led by solid demand for semiconductor-producing equipment, computer chips and food, which offset lower shipments of automobiles, ships and construction/mining equipment. Export volumes were down 2.6 percent for the first drop in two months amid struggling economic recovery in China and parts of Europe. Japanese export values rose 2.8 percent on year in December (close to consensus +3.0 percent) to a record high ¥9.91 trillion, posting their third straight year-on-year rise and leading to an unexpected trade surplus. The increase was led by solid demand for semiconductor-producing equipment, computer chips and food, which offset lower shipments of automobiles, ships and construction/mining equipment. Export volumes were down 2.6 percent for the first drop in two months amid struggling economic recovery in China and parts of Europe.

Import values marked their ninth straight increase, up 1.8 percent (well below consensus +4.4 percent), as demand for computers, non-ferrous metals and non-ferrous metal ore made up for lower purchases of crude oil, semiconductors and smartphones. Import volumes rebounded 1.9 percent.

The trade balance recorded a surplus of ¥130.94 billion for the first positive figure in six months, coming in firmer than the median forecast of a ¥50.0 billion deficit. It followed a revised ¥110.32 billion deficit in November and a ¥323.54 billion deficit in December 2023 and the record shortfall of ¥3,506.43 billion (¥3.51 trillion) in January 2023.

Exports to the United States, which is still the largest market for Japanese exports, dipped 2.1 percent on year after an 8.0 percent fall, marking their fifth straight decline on lower demand for automobiles, construction/mining machinery and drugs but the export amount at ¥2.04 trillion is still the second largest on record. Shipments to the U.S. recorded their first year-on-year decline in 35 months in August 2024 (-0.7 percent) in payback for a high pace of recovery in 2023.

Exports to the European Union edged up 0.5 percent for the first rise in nine months after a 12.5 percent fall propped up by demand for motorcycles, electric measuring instruments and raw materials, which offset declines in shipments of autos, auto parts and iron/steel.

Shipments to China, a key export market for Japanese goods, marked the first drop in three months, down 3.0 percent, after a 4.1 percent gain in the prior month, led by declines in semiconductor-producing equipment, autos and raw materials.

The NAR data on sales of existing homes finished 2024 on an upnote with an increase of 2.2 percent to 4.24 million units at an annual rate in December after an unrevised 4.15 million units in November. The consensus in the Econoday survey of forecasters looks for a level of 4.16 million units in December. Sales picked up toward the end of the year as homebuyers took advantage of more plentiful inventory and more power to negotiate price and terms. Sales are up 9.3 percent compared to December 2023. Homebuyers who had prequalified for mortgages at lower rates also acted before rate locks expired. The NAR data on sales of existing homes finished 2024 on an upnote with an increase of 2.2 percent to 4.24 million units at an annual rate in December after an unrevised 4.15 million units in November. The consensus in the Econoday survey of forecasters looks for a level of 4.16 million units in December. Sales picked up toward the end of the year as homebuyers took advantage of more plentiful inventory and more power to negotiate price and terms. Sales are up 9.3 percent compared to December 2023. Homebuyers who had prequalified for mortgages at lower rates also acted before rate locks expired.

The NAR said that the annual pace of sales for 2024 is 4.06 million units, slightly below 4.09 million units in 2023, and the lowest since 1995.

The Freddie Mac rate for a 30-year fixed rate mortgage averaged about 6.8 percent in November and December. Rates began to move higher around mid-December when it became clear that the FOMC was on hold for further cuts in short-term rates and financial market conditions would not become easier.

Three of four regions have sales gains in December with the Northeast up 3.9 percent, the South up 3.2 percent, and the West up 2.6 percent. Sales decline 1.0 percent in the Midwest.

Sales of single-family homes are up 1.9 percent in December from November and 10.1 percent higher than a year earlier. Sales of multi-family homes are up 5.1 percent in December from the prior month and 2.5 percent from the year-ago month.

The median price for all homes is unchanged at $404,400 in December from November and up 6.0 percent compared to December 2023. The months' supply of homes on the market is down to 3.3 after 3.8 in November and 3.1 in December 2023.

An existing home is listed for an average of 35 days in December, up from 32 days in November and 29 days in December 2023. The share of first-time buyers increases to 31 percent in December from 30 percent in November and 29 percent in December 2024.

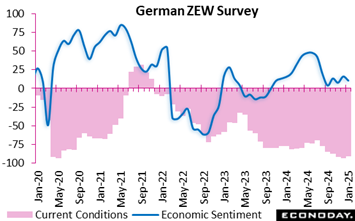

Germany's economic sentiment has deteriorated into 2025, reflecting cautious optimism tempered by harsh realities. The ZEW Indicator's drop to 10.3 points, 5.4 points below December and 3.7 points below the consensus, underscores growing unease about the nation's economic trajectory. Though a slight uptick in the current situation index to minus 90.4 points offers a glimmer of hope, Germany's prolonged recession and stagnant growth paint a sombre picture. Germany's economic sentiment has deteriorated into 2025, reflecting cautious optimism tempered by harsh realities. The ZEW Indicator's drop to 10.3 points, 5.4 points below December and 3.7 points below the consensus, underscores growing unease about the nation's economic trajectory. Though a slight uptick in the current situation index to minus 90.4 points offers a glimmer of hope, Germany's prolonged recession and stagnant growth paint a sombre picture.

Driving the pessimism are negative GDP growth figures, rising inflation, weak household consumption, and a struggling construction sector. The grim forecast suggests Germany may lag further behind its Eurozone peers, where economic sentiment improved modestly to 18.0 points. Stability in the Eurozone's current situation indicator (minus 53.8 points) hints at a region less hindered by domestic challenges.

Political uncertainty adds to Germany's woes, with coalition-building difficulties and global jitters from the new Trump administration. The Eurozone's steadier outlook suggests a growing divergence in resilience across member states.

Germany's economic engine appears stalled, facing headwinds from within and beyond its borders. Without bold policy moves to reignite domestic demand and stabilise sentiment, its role as Europe's economic powerhouse could wane in 2025.

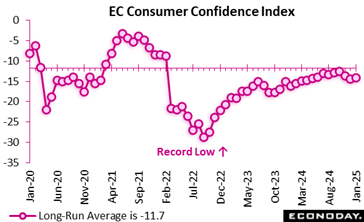

In January 2025, consumer confidence in the euro area showed a slight improvement, rising by 0.3 percentage points compared to December 2024. Despite this increase, confidence remained subdued at -14.2 points, well below its long-term average, reflecting ongoing economic concerns. The economic sentiment indicator had declined in December 2024, falling by 1.9 points to 93.7, indicating weaker overall economic optimism. Similarly, the employment expectations indicator dropped by 1.4 points to 97.3, signalling reduced confidence in labour market prospects. These figures suggest persistent challenges within the euro area economy, with consumer confidence failing to reach pre-pandemic or long-term average levels. In January 2025, consumer confidence in the euro area showed a slight improvement, rising by 0.3 percentage points compared to December 2024. Despite this increase, confidence remained subdued at -14.2 points, well below its long-term average, reflecting ongoing economic concerns. The economic sentiment indicator had declined in December 2024, falling by 1.9 points to 93.7, indicating weaker overall economic optimism. Similarly, the employment expectations indicator dropped by 1.4 points to 97.3, signalling reduced confidence in labour market prospects. These figures suggest persistent challenges within the euro area economy, with consumer confidence failing to reach pre-pandemic or long-term average levels.

The sentiment and employment expectations indicator scores below their historical benchmark of 100 highlight broad uncertainties, possibly linked to inflationary pressures, geopolitical tensions and weaker global demand. While January's marginal recovery in consumer confidence offers a glimmer of hope, the overall outlook remains cautious, requiring targeted policy measures to stabilise economic sentiment and support employment expectations.

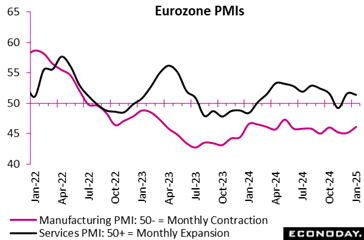

The Eurozone returned to modest growth in January 2025, with the flash composite PMI reaching 50.2, about 0.6 points above consensus, reaching its highest in five months, signalling a slight expansion in private sector activity after six months of contraction. Services led this recovery, with the service PMI at 51.4 (a point below consensus), reflecting continued albeit slower growth, while the manufacturing PMI rose to 46.1, an eight-month high, though still in contraction territory. The Eurozone returned to modest growth in January 2025, with the flash composite PMI reaching 50.2, about 0.6 points above consensus, reaching its highest in five months, signalling a slight expansion in private sector activity after six months of contraction. Services led this recovery, with the service PMI at 51.4 (a point below consensus), reflecting continued albeit slower growth, while the manufacturing PMI rose to 46.1, an eight-month high, though still in contraction territory.

Demand remained weak, with new orders falling for the eighth month. However, the decline slowed, particularly in international markets, where export orders dropped at the softest rate in six months. Employment neared stabilisation as service sector job growth offset manufacturing job cuts, though staffing levels declined slightly overall.

Inflation surged as input costs rose at their fastest pace since April 2023, driven by steep increases in service costs. Output prices followed, rising at a five-month high, with Germany leading this trend, while France recorded its first price drop in nearly four years.

Business confidence remained cautiously optimistic, with manufacturing sentiment improving to a seven-month high. However, ongoing demand weakness, particularly in manufacturing, and mixed trends in key economies like Germany and France highlight the Eurozone's fragile recovery entering 2025.

Monday starts off with China’s CFLP composite PMI, where the manufacturing PMI is expected to be flat at 50.1 compared to a month earlier. Services PMI on the other hand is expected to edge down to 52.1 from 52.2.

Germany’s Ifo survey for January is expected to show no recovery in January after major declines at the end of last year. Business climate is expected at 84.6 versus 84.7 in December. The current conditions index is estimated to be 85.2 versus 85.1 while business expectations are expected to be 84.1 versus 84.4.

Despite a steady rise in 30-year mortgage rates to top 7 percent in December, US new home sales for the month are estimated to reach a 672,000 annual rate after rebounding to 664,000 in November from a weak 627,000 in October.

On Tuesday, United States durable goods orders is expected to show an increase of 0.8 percent on the month in December and an increase of 0.4 percent ex-transportation orders. Core capital goods orders are estimated to rise 0.3 percent.

United States consumer confidence is expected to recover to 106.3 in January after fading to 104.7 in December from a recent high of 112.8 in November and 109.6 in October.

Wednesday, Canada’s Bank of Canada is expected to announce a 25-basis-point rate cut, after two straight rate 50-bp rate cuts. It is estimated that the BOC will slow down for now but more aggressive cuts are still possible later in the year.

On the other hand, the United States FOMC announcement is expected to uniformly have no action from the Fed this time, notwithstanding President Trump’s demand for lower rates. With the economy strong, inflation sticky, and high uncertainty and risk associated with the Trump administration’s policies, the Fed is in no rush to cut rates.

On Thursday, Japan’s Tokyo consumer inflations is expected to inch up further in all three key readings in January. The core reading (excluding fresh food) is forecast to post a 2.5 percent increase on year after rising 2.4 percent in December. The year-on-year rise in the total CPI is also expected to rise to 3.1 percent from 3.0 percent. The annual rate for the core-core CPI (excluding fresh food and energy) is estimated at 1.9 percent, up from 1.8 percent.

Japanese payrolls are expected to post their 29th straight rise on year in December amid widespread labor shortages. The unemployment rate is forecast at 2.5 percent, unchanged from 2.5 percent in November after ticking up to 2.5 percent in October from an eight-month low of 2.4 percent in September. More than a few economists expect the jobless rate to improve slightly to 2.4 percent.

Japan’s industrial production is forecast to post a slight 0.6 percent rebound on the month in December, propped up by solid real exports, after slumping 2.2 percent (revised from 2.3 percent) in November and surging 2.8 percent in October. The monthly survey by the Ministry of Economy, Trade and Industry released last month indicated that output would dip 0.3 percent in December despite an expected rise in production and general machinery before rebounding 1.3 percent in January on vehicles and semiconductors.

Also on Thursday, is Japan’s retail sales for December which is estimated to have risen 2.8 percent on year in December after picking up further to a 2.8 percent increase in November. On the month, retail sales are expected to post a 0.5 percent rise after surging a revised 1.9 percent in November.

France’s gross domestic product for the fourth quarter is expected to stagnate with no change from the third quarter. Germany’s GDP on the other hand is expected to decrease 0.1 percent on the quarter and the same on the year. Italy’s GDP is expected to have a modest 0.2 percent increase on quarter and a gain of 0.6 percent from a year ago. Overall, the Eurozone GDP is estimated to have a very modest 0.2 percent rise on the quarter and 1.0 percent on year. That compares with 0.4 percent on quarter and 0.9 percent on year in Q3.

Also on the Eurozone, the ECB is expected to announce a non-controversial 25-bp rate cut on Thursday.

Friday, France’s headline consumer price index is expected to go up 1.5 percent from a year ago versus 1.3 percent in December.

Germany’s CPI is expected to rise 0.1 percent on the month and 2.6 percent on year after rising 0.5 percent on the month and 2.6 percent on year in December.

Also on Friday, Canada’s monthly GDP is expected to shrink by 0.1 percent in November from October, in line with the Stats Canada forecast, and reflecting declines in retail and wholesale trade and in manufacturing.

China CFLP Composite PMI for January (Mon 0930 CST; Mon 0130 GMT; Sun 2030 EST)

Consensus Forecast, Manufacturing Index: 50.1

Consensus Range, Manufacturing Index: 50.1 to 50.3

Consensus Forecast, Non-Manufacturing Index: 52.1

Consensus Range, Non-Manufacturing Index: 51.5 to 52.2

Business activity is treading water with the manufacturing PMI expected to be flat at 50.1 from a month earlier. Services PMI is expected to edge down to 52.1 from 52.2.

Germany Ifo Survey for January (Mon 1000 CET; Mon 0900 GMT; Mon 0400 EST)

Consensus Forecast, Business Climate: 84.6

Consensus Range, Business Climate: 84.3 to 86.5

Consensus Forecast, Current Conditions: 85.2

Consensus Range, Current Conditions: 84.8 to 85.5

Consensus Forecast, Business Expectations: 84.1

Consensus Range, Business Expectations: 84.0 to 85.0

Ifo business sentiment readings tanked headed into year end with no recovery evident in January. Business climate is expected at 84.6 versus 84.7 in December. Current conditions index is seen at 85.2 versus 85.1 and expectations at 84.1 versus 84.4.

United States New Home Sales for December (Mon 1000 EST; Mon 1500 GMT)

Consensus Forecast, Annual Rate: 672,000

Consensus Range, Annual Rate: 640,000 to 700,000

Despite a steady rise in 30-year mortgage rates to top 7 percent in December, new home sales are seen at a 672,000 annual rate after rebounding to 664,000 in November from a weak 627,000 in October.

United States Durable Goods Orders for December (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast, New Orders - M/M: 0.8%

Consensus Range, New Orders - M/M: -4.5% to 2.2%

Consensus Forecast, Ex-Transportation - M/M: 0.4%

Consensus Range, Ex-Transportation - M/M: 0.3% to 0.6%

Consensus Forecast, Core Capital Goods - M/M: 0.3%

Consensus Range, Core Capital Goods - M/M: 0.2% to 0.5%

Durable goods orders expected to show an increase of 0.8 percent on the month in December and an increase of 0.4 percent ex-transportation orders. Core capital goods orders are seen rising 0.3 percent.

United States Case-Shiller Home Price index for November (Tue 0900 EST; Tue 1400 GMT)

Consensus Forecast, 20-City Adjusted - M/M: 0.3%

Consensus Range, 20-City Adjusted - M/M: 0.2% to 0.3%

Consensus Forecast, 20-City Unadjusted - Y/Y: 4.1%

Consensus Range, 20-City Unadjusted – Y/Y: 4.0% to 4.3%

Case Shiller has depicted a steady slowing in the rate of annual home price inflation with the 20-city composite index up 4.2 percent in October, down from 4.6 percent in September, 5.2 percent in August and 5.9 percent in July. Forecasters look for more slowing/an uptick to 4.1 percent in November. The consensus looks for the same 0.3 percent increase on the month after a 0.3 percent rise in October.

United States Consumer Confidence index for January (Tue 1000 EST; Tue 1500 GMT)

Consensus Forecast, Consumer Confidence: 106.3

Consensus Range, Consumer Confidence: 104.0 to 108.5

Consumer confidence is seen recovering to 106.3 in January after fading to 104.7 in December from a recent high of 112.8 in November and 109.6 in October.

Australia Monthly CPI for December (Wed 1130 AET; Wed 0030 GMT; Tue 1930 EST)

Consensus Forecast, Y/Y: 2.5%

Consensus Range, Y/Y: 2.3% to 2.6%

The consensus looks for CPI up 2.5 percent on the year in December versus 2.3 percent in November. Forecasters cite accelerating price increases for fuel, clothing and holiday travel.

Australia CPI for Fourth Quarter (Wed 1130 AET; Wed 0030 GMT; Tue 1930 EST)

Consensus Forecast, Q/Q: 0.4%

Consensus Range, Q/Q: 0.0% to 0.6%

Consensus Forecast, Y/Y: 2.6%

Consensus Range, Y/Y: 2.2% to 2.7%

Government subsidies for transportation, energy, rent, and other help for consumers are keeping inflation low. Expectations call for a quarterly rise of 0.4 percent with CPI up 2.6 percent on the year in Q4 versus 0.2 percent on quarter and 2.8 percent on year in Q3.

Eurozone M3 Money Supply for December (Wed 1000 CET; Wed 0900 GMT; Wed 0400 EST)

Consensus Forecast, Y/Y-3-Month Moving Average: 4.0%

Consensus Range, Y/Y-3-Month Moving Average: 3.4% to 4.0%

M3 is seen up 4.0 percent versus 3.5 percent in December.

Canada Bank of Canada Announcement (Wed 0945 EST; Wed 1445 GMT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Level: 3.0%

Consensus Range, Level: 3.0% to 3.0%

After two straight 50 bp rate cuts, the BOC is expected to slow down – for now. Forecasters uniformly look for a 25 rate cut. They are watching for more aggressive cuts later in the year given the weak inflation picture and downside risks if Tariff Man delivers on his threats.

United States International Trade in Goods (Advance) for December (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, Balance: -$105.5 B

Consensus Range, Balance: -$115.1 B to -$101.0 B

Forecasters expect the trade gap to widen to $105.5 billion from $103.4 billion in November.

United States Wholesale Inventories (Advance) for December (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.1% to 0.4%

The consensus looks for an increase of 0.3 percent.

United States FOMC Announcement (Wed 1400 EST; Wed 1900 GMT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 4.375%

Consensus Range, Level: 4.375% to 4.375%

Forecasters uniformly expect no action from the Fed this time, notwithstanding President Trump’s demand for lower rates. With the economy strong, inflation sticky, and high uncertainty and risk associated with the Trump administration’s policies, the Fed is in no rush to cut rates.

Japan Tokyo CPI for January (Thu 0830 JST; Thu 2330 GMT; Thu 1830 EST)

Consensus Forecast, CPI - Y/Y: 3.1%

Consensus Range, CPI - Y/Y: 3.0% to 3.2%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.5%

Consensus Range, Ex-Fresh Food - Y/Y: 2.4% to 2.6%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y: 1.9%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 1.8% to 1.9%

Consumer inflation in Tokyo, the leading indicator of the national average, is expected to inch up further in all three key readings in January. Three-month utility subsidies for peak time air conditioner use ended in November (bills were paid in December) while processed food prices remained high in protracted rice shortages.

The core reading (excluding fresh food) is forecast to post a 2.5% increase on year after rising 2.4% in December. The year-on-year rise in the total CPI is also expected to rise to 3.1% from 3.0%. The annual rate for the core-core CPI (excluding fresh food and energy) is estimated at 1.9%, up from 1.8%.

The Bank of Japan, which expects inflation to be anchored around its 2% target by early 2026, is on course for at least two more 25 basis point rate hikes that would take the overnight interest rate target to 1% by late 2025 or early 2026 as part of its gradual normalization process begun in March 2024 after more than a decade of large-scale easing.

At its two-day meeting that ended on Friday, the BOJ's nine-member board, as widely expected, voted 8 to 1 to raise the policy interest rate by another 25 basis points (0.25 percentage point) to 0.5%. Citing "significantly low" real interest rates, the board repeated its latest conviction that it should be able to continue raising the target for overnight interest rates and "adjust the degree of monetary accommodation" without hurting economic activity.

Japan Unemployment Rate for December (Thu 0830 JST; Thu 2330 GMT; Thu 1830 EST)

Consensus Forecast, Rate: 2.5%

Consensus Range, CPI - Y/Y: 2.4% to 2.5%

Japanese payrolls are expected to post their 29th straight rise on year in December amid widespread labor shortages. The unemployment rate is forecast at 2.5%, unchanged from 2.5% in November after ticking up to 2.5% in October from an eight-month low of 2.4% in September. More than a few economists expect the jobless rate to improve slightly to 2.4%. The government continues to describe employment conditions as "showing signs of improvement" in its latest monthly economic report.

Japan Industrial Production Rate for December (Thu 0850 JST; Thu 2350 GMT; Thu 1850 EST)

Consensus Forecast, M/M: 0.6%

Consensus Range, M/M: 0.3% to 1.5%

Consensus Forecast, Y/Y: -1.0%

Consensus Range, Y/Y: -3.2% to 0.2%

Japan's industrial production is forecast to post a slight 0.6% rebound on the month in December, propped up by solid real exports, after slumping 2.2% (revised from 2.3%) in November and surging 2.8% in October. The monthly survey by the Ministry of Economy, Trade and Industry released last month indicated that output would dip 0.3% in December despite an expected rise in production and general machinery before rebounding 1.3% in January on vehicles and semiconductors.

From a year earlier, factory output is expected to have fallen 1.0%, following a 2.7% drop (revised from -2.8%) in November and a 1.4% gain in October. Last month, the ministry maintained its assessment, saying industrial output is "taking one step forward and one step back." It said it will keep a close watch on how global economic growth evolves.

Japan Retail Sales for December (Thu 0850 JST; Thu 2350 GMT; Thu 1850 EST)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: -1.4% to 0.7%

Consensus Forecast, Y/Y: 2.8%

Consensus Range, Y/Y: 2.3% to 4.8%

Japanese retail sales are forecast to have risen 2.8% on year in December after picking up further to a 2.8% increase in November from a 1.3% rise in October as the cold snap propped up demand for winter clothing. Higher gasoline prices pushed up fuel sales while department store sales remain solid, although high costs for necessities are keeping households wary of spending beyond necessities.

On the month, retail sales are expected to post a 0.5% rise after surging a revised 1.9% in November. Last month the Ministry of Economy, Trade and Industry maintained its assessment after downgrading it for the October data, saying retail sales are "taking one step forward and one step back." Previously, it had said sales were "on an uptrend."

France GDP Flash for Fourth Quarter (Thu 0730 CET; Thu 0630 GMT; Thu 0130 EST)

Consensus Forecast, Q/Q: 0.0%

Consensus Range, Q/Q: 0.0% to 0.1%

The consensus sees a stagnant no change in GDP in Q4 from Q3.

Germany GDP Flash for Fourth Quarter (Thu 1000 CET; Thu 0900 GMT; Thu 0400 EST)

Consensus Forecast, Q/Q: -0.1%

Consensus Range, Q/Q: -0.1% to 0.0%

Consensus Forecast, Y/Y: -0.1%

Consensus Range, Y/Y: -0.2% to 0.1%

Forecasters look for a 0.1 percent decrease on quarter and on year.

Italy GDP for Fourth Quarter (Thu 1000 CET; Thu 0900 GMT; Thu 0400 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.1% to 0.2%

Consensus Forecast, Y/Y: 0.6%

Consensus Range, Y/Y: 0.6% to 0.7%

Forecasters see a modest 0.2 percent increase on quarter and a gain of 0.6 percent from a year ago.

Eurozone EC Economic Sentiment for January (Thu 1100 CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, Economic Sentiment: 93.5

Consensus Range, Economic Sentiment: 93.3 to 94.4

Consensus Forecast, Industry Sentiment: -14.2

Consensus Range, Industry Sentiment: -14.5 to -13.8

No relief in the gloom: Economic sentiment is expected to weaken to 93.5 in January from 93.7 in December. Industry sentiment is expected down to minus 14.2 versus minus 14.1.

Eurozone GDP Flash for Fourth Quarter (Thu 1100 CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.0% to 0.3%

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: 0.9% to 1.2%

The consensus view is the economy slowed headed in Q4 with a very modest 0.2 percent rise on the quarter and 1.0 percent on year. That compares with 0.4 percent on quarter and 0.9 percent on year in Q3.

Eurozone ECB Announcement (Thu 1415 CET; Thu 1315 GMT; Thu 0815 EST)

Consensus Forecast, Refi Rate Change: -25 bp

Consensus Range, Refi Rate Change: -25 bp to -25 bp

Consensus Forecast, Refi Rate Level: 2.90%

Consensus Range, Refi Rate Level: 2.90% to 2.90%

Consensus Forecast, Deposit Rate Change: -25 bp

Consensus Range, Deposit Rate Change: -25 bp to -25 bp

Consensus Forecast, Deposit Rate Level: 2.75%

Consensus Range, Deposit Rate Level: 2.75% to 2.75%

After the latest comments from President Christine Lagarde, all expect a non-controversial 25 bp rate cut.

United States GDP for Fourth Quarter (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Q/Q - Annual Rate: 2.7%

Consensus Range, Q/Q - Annual Rate: 2.3% to 3.0%

Consensus Forecast, Personal Consumer Expenditures - Annual Rate: 3.1%

Consensus Range, Personal Consumer Expenditures - Annual Rate: 2.9% to 3.7%

The economy keeps ticking along and the call for the first reading of GDP for Q4 looks for growth of 2.7 percent with a lift from strong consumption at year end.

United States Jobless Claims (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Initial Claims - Level: 224K

Consensus Range, Initial Claims - Level: 218K to 230K

After a surprising increase of 6,000 to 223,000 last week from 217,000, forecasters see claims remaining elevated at 224,000. Is the labor market finally starting to crack?

United States Pending Home Sales Index for December (Thu 1000 EST; Thu 1500 GMT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: -1.0% to 1.0%

Despite rising mortgage rates, sales have gained for four consecutive months and forecasters expect another increase of 0.4 percent.

Germany Retail Sales for December (Fri 0800 CET; Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.2% to 0.9%

Consensus Forecast, Y/Y: 2.6%

Consensus Range, Y/Y: 1.9% to 3.0%

Retail sales are expected flat on the month, not an inspiring performance after a decline of 0.6 percent in November. The consensus also sees sales up 2.6 percent from a year ago versus 2.5 percent in November.

France CPI for January (Fri 0845 CET; Fri 0745 GMT; Fri 0245 EST)

Consensus Forecast, CPI - Y/Y: 1.5%

Consensus Range, CPI - Y/Y: 1.5% to 1.5%

Headline CPI is expected up 1.5 percent from a year ago versus 1.3 percent in December.

Germany Unemployment Rate for January (Fri 0955 CET; Fri 0855 GMT; Fri 0355 EST)

Consensus Forecast, Rate: 6.2%

Consensus Range, Rate: 6.1% to 6.2%

The jobless rate is expected at 6.2 percent in January, up from 6.1 percent in December.

Eurozone Unemployment Rate for December (Fri 1100 CET; Fri 1000 GMT; Fri 0500 EST)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.4%

Forecasters expect the jobless rate flat at 6.3 percent.

Germany CPI for January (Fri 1400 CET; Fri 1300 GMT; Fri 0800 EST)

Consensus Forecast, CPI - M/M: 0.1%

Consensus Range, CPI - M/M: -0.2% to 0.3%

Consensus Forecast, CPI - Y/Y: 2.6%

Consensus Range, CPI - Y/Y: 2.4% to 2.8%

Consensus Forecast, HICP - M/M: -0.4%

Consensus Range, HICP - M/M -0.4% to -0.3%

Consensus Forecast, HICP - Y/Y: 2.7%

Consensus Range, HICP - Y/Y: 2.6% to 3.0%

CPI is expected up 0.1 percent on the month and 2.6 percent on year after rising 0.5 percent on the month and 2.6 percent on year in December.

Canada Monthly GDP for November (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.1% to 0.0%

Forecasters expect GDP to shrink by 0.1 percent in November from October, in line with the Stats Canada forecast, and reflecting declines in retail and wholesale trade and in manufacturing.

United States Personal Income and Outlays for December (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Personal Income - M/M: 0.4%

Consensus Range, Personal Income - M/M: 0.3% to 0.7%

Consensus Forecast, Personal Consumption Expenditures - M/M: 0.5%

Consensus Range, Personal Consumption Expenditures - M/M: 0.3% to 0.6%

Consensus Forecast, PCE Price Index - M/M: 0.3%

Consensus Range, PCE Price Index - M/M: 0.3% to 0.3%

Consensus Forecast, PCE Price Index - Y/Y: 2.6%

Consensus Range, PCE Price Index - Y/Y: 2.5% to 2.6%

Consensus Forecast, Core PCE Price Index - M/M: 0.2%

Consensus Range, Core PCE Price Index - M/M: 0.2% to 0.2%

Consensus Forecast, Core PCE Price Index - Y/Y: 2.8%

Consensus Range, Core PCE Price Index - Y/Y: 2.8% to 2.8%

Income is seen up 0.4 percent and nominal outlays up 0.5 percent in the latest month. The PCE price index is seen up 0.3 percent on the month and up 2.6 percent from a year ago. Core PCE is seen up 0.2 percent on the month and up 2.8 percent on the year.

United States Employment Cost Index for Fourth Quarter (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Q/Q: 0.9%

Consensus Range, Q/Q: 0.7% to 1.1%

Employment costs are expected up 0.9 percent on the quarter in Q4 versus 0.8 percent in Q3.

United States Chicago PMI for January (Fri 9:45 EST; Fri 14:45 GMT)

Consensus Forecast: 40.0

Consensus Range, 37.2 – 41.0

Forecasters look for a modest recovery to a still highly contractionary 40.0 in January after its third consecutive monthly decline to 36.9 in December, its lowest since May 2024.

|