|

The Week Ahead: Highlights

US Preview

Employment in Focus as Data Calendar Picks Up

By Theresa Sheehan, Econoday Economist

The data release schedule is getting back on track in the

January 5 week, although there remain some delayed reports. The process should

be completed by the end of the month. In the meantime, the winter holiday

period is over and there is a full five-day business week ahead.

Much of the data in the January 5 week is related to the

labor market in December and will close out its performance in the fourth

quarter 2025. This will give Fed policymakers a better picture of conditions

and enable the FOMC to set monetary policy with greater confidence when they

next meet on January 27-28.

The ADP national employment report for December at 8:15 ET

on Wednesday will provide a look at private payrolls. Private payrolls have

been trending lower since the start of 2025, albeit unevenly. The average

monthly increase in the first 11 months of 2025 is 52,000. The December number

is probably below that. Hiring has been concentrated in a few narrow sectors

at mid- and large-sized establishments. There may be a pause at year-end as

companies assess their needs for 2026.

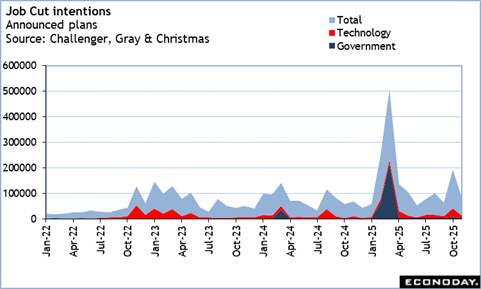

The Challenger report on job cut intentions for December at

7:30 ET on Thursday will confirm that layoff activity was higher in 2025 than

in 2024 even excluding the cuts related to DOGE actions. The rapid and

extensive adoption of AI tools has been taking the blame for many job cuts. It

is important to remember that job cuts are not necessarily outright job losses

but also include elimination of open positions and future hiring plans.

Moreover, not all planned job cuts end up taking place should circumstances

change.

The December employment report is being released on its

originally announced date at 8:30 ET on Friday. The report will include the

annual revisions to the household survey. Normally there are only minor and

offsetting revisions to the numbers like the unemployment rate. Revisions

usually go back five years. The unemployment rate has been creeping upward.

Although at 4.6 percent in November it remains at levels historically

consistent with a healthy labor market, it is above the FOMC's longer-run forecast

of 4.2 percent.

The revisions to the establishment survey will be released

with the January data on February 6 and large downward revisions to the payroll

numbers are expected. December payroll increases could remain near the 64,000

gain in November. This sort of increase looks tepid compared to the last few

years. The early consensus for an increase of about 50,000 probably reflects

ongoing hiring a sectors like healthcare where skilled workers remain in

demand. Elsewhere, businesses are more reluctant to hire until some of the

uncertainty about the economic outlook has faded.

The December survey reference period ended on December 13

which means that it was well before the holidays might have interfered with

data collection. However, it also means that some hiring might have been

missed. December typically sees the payroll count come in above the market

expectation but also subsequently being revised upward.

The Week Ahead: Econoday Consensus Forecasts

Monday

China PMI Composite for December (Mon 0945 CST; Mon

0145 GMT; Sun 2045 EST)

Consensus Forecast, Composite Index: 51.0

Consensus Range, Composite Index: 51.0 to 51.0

Consensus Forecast, Services Index: 52.0

Consensus Range, Services Index: 51.8 to 52.0

The services index is expected to hold nearly steady at 52.0

in December from 52.1 in November. The composite is seen at 51.0 versus 51.2.

Both suggest ongoing modest expansion.

US Motor Vehicle Sales for December (ANYTIME)

Consensus Forecast, Total Vehicle Sale - Annual Rate:

15.7 M

Consensus Range, Total Vehicle Sale - Annual Rate: 15.3

M to 15.9 M

Sales expected to remain pretty flat and unimpressive at 15.7

million units in December versus 15.6 million in November.

US ISM Manufacturing Index for December (Mon 1000

EST; Mon 1500 GMT)

Consensus Forecast, Index: 48.3

Consensus Range, Index: 48.0 to 48.8

The consensus forecast looks for no recovery in the manufacturing

index with ongoing slow contraction at 48.3 in January. Business activity weakened

more than expected to 48.2 in December from 48.7 in November.

Tuesday

India PMI Composite Final for December (Tue 1030 IST;

Tue 0500 GMT; Tue 0000 EST)

Consensus Forecast, Services Index: 59.1

Consensus Range, Services Index: 59.1 to 59.3

The services index is expected at 59.1 in the December

final, unrevised from the flash and down from 59.8 in November.

France CPI for December (Tue 0845 CEST; Tue 0745 GMT;

Tue 0245 EST)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.2%

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.7% to 0.9%

Consensus Forecast, HICP - M/M: 0.2%

Consensus Range, HICP - M/M: 0.2% to 0.2%

Consensus Forecast, HICP - Y/Y: 0.8%

Consensus Range, HICP - Y/Y: 0.8% to 0.8%

The consensus looks for the first reading for CPI for

December at up 0.2 percent on the month and up 0.9 percent on year after

declining 0.1 percent on the month and rising 0.9 percent on year in November.

Eurozone PMI Composite Final for December (Tue 1000

CET; Tue 0900 GMT; Tue 0400 EST)

Consensus Forecast, Composite Index: 51.9

Consensus Range, Composite Index: 51.9 to 51.9

Consensus Forecast, Services Index: 52.6

Consensus Range, Services Index: 52.6 to 52.6

The final composite is expected unrevised from the flash at

51.9 in the final report for December and down from 52.8 in November. The final

services index is expected unrevised from the flash at 52.6 in the final report

for December and down from 53.6 in November.

France PMI Composite Final for December (Tue 0950

CET; Tue 0850 GMT; Tue 0350 EST)

Consensus Forecast, Composite Index: 50.1

Consensus Range, Composite Index: 50.1 to 50.1

Consensus Forecast, Services Index: 50.2

Consensus Range, Services Index: 50.2 to 50.2

The final composite is expected unrevised at 50.1 in the

final report for December from the flash and down from 50.4 in November. The

final services index is expected unrevised from the flash at 50.2 in the final

report for December and down from 51.4 November.

Germany PMI Composite Final for December (Tue 0955

CET; Tue 0855 GMT; Tue 0355 EST)

Consensus Forecast, Composite Index: 51.5

Consensus Range, Composite Index: 51.5 to 51.5

Consensus Forecast, Services Index: 52.6

Consensus Range, Services Index: 52.6 to 52.6

The final composite is expected unrevised at 51.5 in the

final report for December from the flash and down from 52.4 in November. The

final services index is expected unrevised from the flash at 52.6 in the final

report for December and down from 53.1 November.

UK PMI Composite Final for December (Tue 0930 GMT; Tue

0430 EST)

Consensus Forecast, Composite Index: 52.1

Consensus Range, Composite Index: 52.1 to 52.1

Consensus Forecast, Services Index: 52.1

Consensus Range, Services Index: 52.1 to 52.1

The final composite is expected unrevised at 52.1 in the

final report for December from the flash and versus 51.2 in November. The final

services index is expected unrevised from the flash at 52.1 in the final report

for December and up from 51.3 November.

Germany CPI for December (Tue 0800 CET; Tue 0700 GMT;

Tue 0200 EST)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.1% to 0.4%

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 1.9% to 2.2%

The consensus looks for the first reading for CPI for

December at up 0.4 percent on the month and up 2.2 percent on year after

declining 0.2 percent on the month and rising 2.3 percent on year in November.

US PMI Composite Final for December (Tue 0945 GMT; Tue

1445 EST)

Consensus Forecast, Composite Index: 53.0

Consensus Range, Composite Index: 53.0 to 53.0

Consensus Forecast, Services Index: 52.9

Consensus Range, Services Index: 52.9 to 52.9

The composite is expected unrevised from the flash at 53.0

for December, down from 54.2 in November. The consensus sees the services index

unrevised from 52.9 for December, down from 54.1 in November. Both suggest resilience

and ongoing moderate expansion in business activity.

Wednesday

Australia Monthly CPI for November (Wed 1130 AET; Wed

0030 GMT; Tue 1930 EST)

Consensus Forecast, Y/Y: 3.6%

Consensus Range, Y/Y: 3.6% to 3.8%

The consensus sees annual CPI inflation at 3.6 percent for

November versus 3.8 percent in October.

Germany Retail Sales for November (Wed 0800 CEST; Wed

0700 GMT; Wed 0200 EST)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.6%

Consensus Forecast, Y/Y: 0.1%

Consensus Range, Y/Y: 0.1% to 1.2%

Sluggishness expected with sales up 0.2 percent on the month

and 0.1 percent on year in November.

Germany Unemployment Rate for November (Wed 0955

CEST; Wed 0855 GMT; Wed 0455 EST)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.3%

More of the same with the jobless rate stuck at 6.3 percent.

Eurozone HICP Flash for December (Wed 1100 CEST; Wed 0900

GMT; Wed 0500 EST)

Consensus Forecast, HICP - Y/Y: 2.0%

Consensus Range, HICP - Y/Y: 1.9% to 2.1%

Consensus Forecast, Narrow Core - Y/Y: 2.4%

Consensus Range, Narrow Core - Y/Y: 2.3% to 2.4%

HICP expected at 2.0 percent on year in the first report for

December versus 2.1 percent in November. Narrow core is expected unchanged at 2.4

percent versus 2.4 percent in November.

US ADP Employment Report for December (Wed 0815 EST;

Wed 1315 GMT)

Consensus Forecast, Private Payrolls - M/M: 47K

Consensus Range, Private Payrolls - M/M: 25K to 75K

Private payrolls are seen up 47 K in December after dropping

32K in November. If this is the new normal for monthly job growth, it is not

impressive.

US ISM Services Index for December (Wed 1000 GMT; Wed

1500 EST)

Consensus Forecast, Services Index: 52.2

Consensus Range, Services Index: 51.0 to 52.8

The consensus sees services index suggesting more slow

growth at 52.2 versus 52.6 in November.

Thursday

Australia International Trade in Goods for November (Thu

1130 AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Balance: A$5.55 B

Consensus Range, Balance: A$3.7 B to A$5.55 B

Forecasters expect the surplus wider at A$5.55 billion in

November from A$4.38 billion in October.

Germany Manufacturing Orders for November (Thu 0800

CET; Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, M/M: -0.7%

Consensus Range, M/M: -1.3% to 0.5%

Orders are seen falling back by 0.7 percent in November

after rising 1.5 percent in October on month.

Eurozone Unemployment Rate for November (Thu 0800

CET; Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, Rate: 6.4%

Consensus Range, Rate: 6.3% to 6.4%

The consensus sees the jobless rate flat at 6.4 percent.

Eurozone EC Economic Sentiment for December (C 1100

CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, Economic Sentiment: 96.9

Consensus Range, Economic Sentiment: 96.9 to 97.2

Consensus Forecast, Industry Sentiment: -9.0

Consensus Range, Industry Sentiment: -9.0 to -9.0

Consensus Forecast, Consumer Sentiment: -14.6

Consensus Range, Consumer Sentiment: -14.6 to -14.6

Economic sentiment is expected flat to weaker at 96.9 for

December from 97.0 in November.

Canada Merchandise Trade for October (Thu 0830 EST; Thu

1330 GMT)

Consensus Forecast, Balance: -C$1.5 B

Consensus Range, Balance: -C$6.3 B to -C$0.3 B

The trade deficit is expected to widen slightly to C$1.5

billion from C$0.153 billion in September.

US International Trade in Goods and Services for October (Thu

0830 GMT; Wed 1330 EST)

Consensus Forecast, Balance: -$59.1 B

Consensus Range, Balance: -$65.8 B to -$52.8 B

The trade gap is expected at $59.1 billion.

US Jobless Claims for Week 1/2 (Thu 0830 GMT; Wed

1330 EST)

Consensus Forecast, Initial Claims - Level: 205K

Consensus Range, Initial Claims - Level: 200K to 219K

Claims seen at a still-low 205K after a surprising 16K drop

to 199K in the previous holiday week.

US Productivity and Costs for Third Quarter (Thu 0830

EST; Th 1330 GMT)

Consensus Forecast, Nonfarm Productivity - Annual Rate:

3.6%

Consensus Range, Nonfarm Productivity - Annual Rate: 1.0%

to 5.4%

Consensus Forecast, Unit Labor Costs - Annual Rate: 0.8%

Consensus Range, Unit Labor Costs - Annual Rate: -1.4%

to 2.0%

Productivity growth rate seen rising to 3.6 percent and ULC

at 0.8 percent in the first reading for Q3.

United States Wholesale Inventories (Preliminary) for October

(Thu 1000 EST; Thu 1500 GMT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.1% to 0.3%

Inventories expected up 0.2 percent for October.

Friday

Japan Household Spending for November (Fri 0830 JST;

Fri 2330 GMT; Fri 1930 EST)

Consensus Forecast, M/M: 1.4%

Consensus Range, M/M: 0.4% to 3.3%

Consensus Forecast, Y/Y: -1.4%

Consensus Range, Y/Y: -2.5% to -0.6%

Japan's real household spending is expected to fall 1.4

percent from a year earlier in

November after unexpectedly dropping 3.0% the previous

month, weighed down by

weaker food spending, declines in auto purchases and lower

mobile communication

fees as households shifted to cheaper plans.

On a month-on-month basis, household spending is expected to

rebound, rising 1.4 percent

in November after falling 3.5% in the previous month. The

monthly increase is seen

being supported by firmer sales at department stores and

convenience stores.

Germany Industrial Production for November (Fri 0800

CET; Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.4% to 0.5%

The consensus sees output flat in November from October

after a big 1.8 percent rise on month in October.

Germany Merchandise Trade for November (Fri 0800 CET;

Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, Balance: E16.6 B

Consensus Range, Balance: E16.2 B to E17.1 B

The chronic surplus expected almost flat at E16.6 billion

from E16.9 billion in October.

France Industrial Production for November (Fri 0845

CET; Fri 0745 GMT; Fri 0245 EST)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.2% to 0.6%

Output seen down 0.1 percent on the month in November after

the same 0.1 percent decrease in October.

Eurozone Retail Sales for November (Fri 1100 CET; Fri

1000 GMT; Fri 0500 EST)

Consensus Forecast, Y/Y: 1.6%

Consensus Range, Y/Y: 1.5% to 1.9%

Annual growth at 1.6 percent expected for November versus

1.5 percent in October.

Brazil CPI Flash for December (Fri 0900 BRT; Fri 1200

GMT; Fri 0700 EST)

Consensus Forecast, Y/Y: 4.35%

Consensus Range, Y/Y: 4.27% to 4.40%

The consensus looks for CPI up 4.35 percent on year in the

December flash after 4.46 percent in November.

Canada Labour Force Survey for December (Fri 0830

EST; Fri 1330 GMT)

Consensus Forecast, Employment - M/M: -5K

Consensus Range, Employment - M/M: -35K to 40K

Consensus Forecast, Unemployment Rate: 6.7%

Consensus Range, Unemployment Rate: 6.6% to 6.8%

Decline of 5K jobs is the call for December with jobless

rate up to 6.7 percent from 6.5 percent in November.

US Housing Starts and Permits for September (Fri 0830

EST; Fri 1330 GMT)

Consensus Forecast, Starts - Annual Rate: 1.315M

Consensus Range, Starts - Annual Rate: 1.264M to 1.350M

Consensus Forecast, Permits - Annual Rate: 1.347M

Consensus Range, Permits - Annual Rate: 1.325M to 1.370M

Starts expected to remain sluggish at a 1.315 million rate

in September versus 1.307 million in August.

US Housing Starts and Permits for October (Fri 0830

EST; Fri 1330 GMT)

Consensus Forecast, Starts - Annual Rate: 1.330M

Consensus Range, Starts - Annual Rate: 1.300M to 1.400M

Consensus Forecast, Permits - Annual Rate: 1.340M

Consensus Range, Permits - Annual Rate: 1.307M to 1.369M

The call for October housing starts is a 1.330 million unit

rate. Permits are seen at a 1.340 million unit rate.

US Employment Situation for December (Fri 0830 EDT;

Fri 1230 GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 55K

Consensus Range, Nonfarm Payrolls - M/M: 40K to 100K

Consensus Forecast, Unemployment Rate: 4.6%

Consensus Range, Unemployment Rate: 4.5% to 4.6%

Consensus Forecast, Private Nonfarm Payrolls - M/M: 55K

Consensus Range, Private Nonfarm Payrolls - M/M: 40K

to 85K

Consensus Forecast, Manufacturing Employment - M/M: -10K

Consensus Range, Manufacturing Employment - M/M: -15K

to -3K

Consensus Forecast, AHE - M/M: 0.3%

Consensus Range, AHE - M/M: 0.3% to 0.3%

Consensus Forecast, AHE - Y/Y: 3.6%

Consensus Range, AHE - Y/Y: 3.6% to 3.6%

Consensus Forecast, Weekly hours - 34.3

Consensus Range, Weekly hours 34.2 to 34.3

Payrolls seen up a moderate 55K with the jobless rate flat

at 4.6 percent.

US Consumer Sentiment for January preliminary (Fri

1000 EST; Fri 1500 GMT)

Consensus Forecast, Index: 53.5

Consensus Range, Index: 52.7 to 55.0

Sentiment seen up marginally to 53.5 in the first report for

January from 52.9 in December.

|